PROPERTY COOLING MEASURES

Measures For A Sustainable Property Market

MOF Press Release – 26 April 2023

1. The Government announced today increases in the Additional Buyer’s Stamp Duty (ABSD) rates to promote a sustainable property market. The revised rates will take effect from 27 April 2023.

2. The implementation of the property market measures in December 2021 and September 2022 have had a moderating effect. However, in 1Q2023, property prices showed renewed signs of acceleration amid resilient demand. Demand from locals purchasing homes for owner-occupation has been especially strong, and there has also been renewed interest from local and foreign investors in our residential property market. If left unchecked, prices could run ahead of economic fundamentals, with the risk of a sustained increase in prices relative to incomes.

Raising Additional Buyer’s Stamp Duty (ABSD) Rates

3. To promote a sustainable property market and prioritise housing for owner-occupation, the Government will raise the ABSD rates further to pre-emptively manage investment demand.

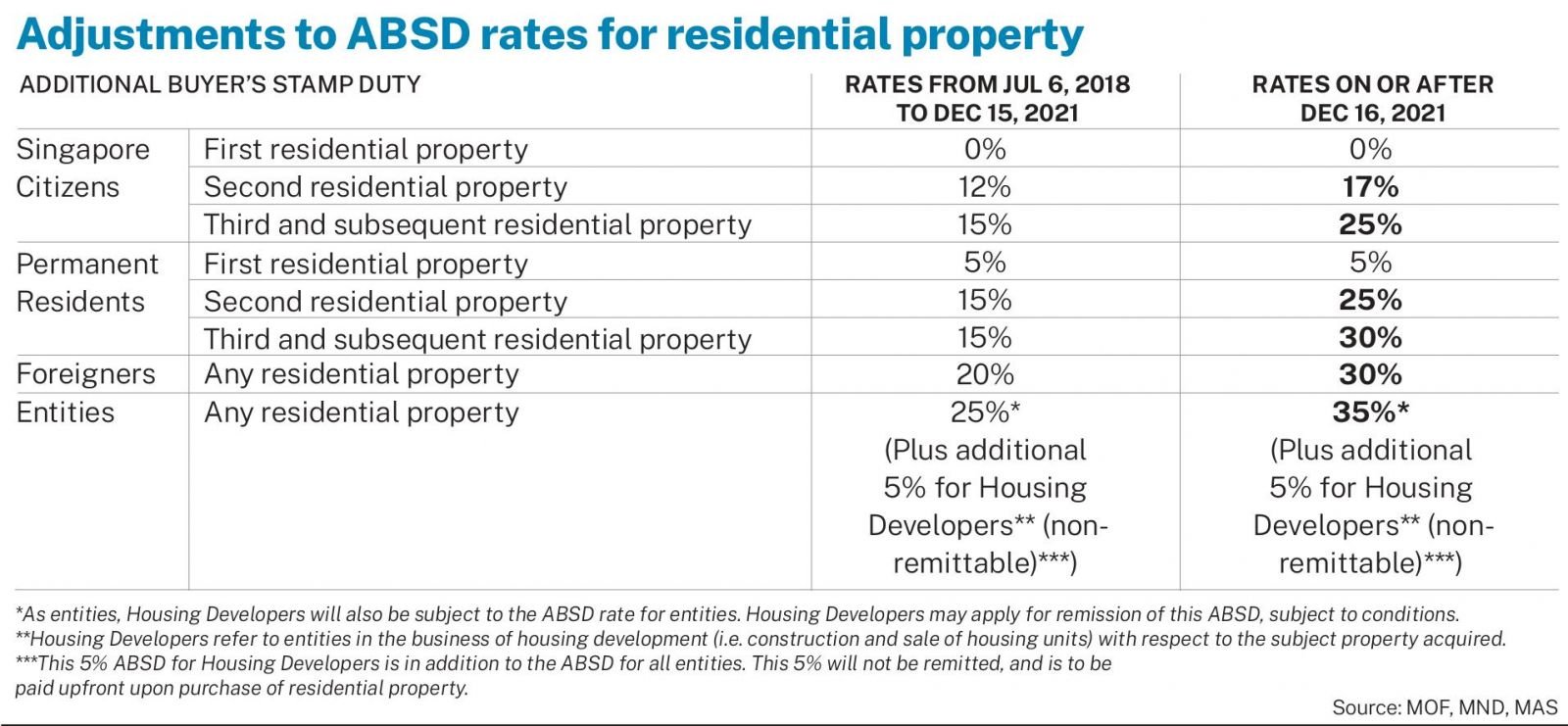

4. The specific ABSD rates increases are as follows:

a. Raise ABSD rate from 17% to 20% for Singapore Citizens (SCs) purchasing their 2nd residential property;

b. Raise ABSD rate from 25% to 30% for SCs purchasing their 3rd and subsequent residential property, and Singapore Permanent Residents (SPRs) purchasing their 2nd residential property;

c. Raise ABSD rate from 30% to 35% for SPRs purchasing their 3rd and subsequent residential property;

d. Raise ABSD rate from 30% to 60% for foreigners purchasing any residential property; and

e. Raise ABSD rate from 35% to 65% for entities or trusts purchasing any residential property, except for housing developers.

5. Based on 2022 data, the above ABSD rate increases will affect about 10% of residential property transactions.

6. The ABSD rates for SCs and SPRs purchasing their first residential property, which constitutes about 90% of residential property transactions based on 2022 data, will remain at 0% and 5% respectively.

7. Table 1 summarises the adjustments to the ABSD rates.

8. For acquisitions made jointly by two or more parties of different profiles, the highest applicable ABSD rate will apply.

9. Married couples with at least one SC spouse, who jointly purchase a second residential property, can continue to apply for a refund of ABSD, subject to conditions. These conditions include selling their first residential property within 6 months after (a) the date of purchase of the second residential property if this is a completed property, or (b) the issue date of the Temporary Occupation Permit (TOP) or Certificate of Statutory Completion (CSC) of the second residential property, whichever is earlier, if the second property is not completed at the time of purchase.

10. The ABSD currently does not affect those buying an HDB flat or Executive Condominium unit from housing developers with an upfront remission, if any of the joint acquirers/purchasers is a SC. There will be no change to this policy.

11. The revised ABSD rates will apply to all residential properties acquired on or after 27 April 2023. There will be a transitional provision, where the ABSD rates on or before 26 April 2023 will apply for cases that meet all the conditions below:

a. The Option to Purchase (OTP) was granted by sellers to potential buyers on or before 26 April 2023;

b. This OTP is exercised on or before 17 May 2023, or within the OTP validity period, whichever is earlier; and

c. This OTP has not been varied on or after 27 April 2023.

12. Correspondingly, the Additional Conveyance Duties for Buyers (ACDB), which applies to qualifying acquisitions of equity interest in property holding entities (PHEs)1 will be raised from up to 46% to up to 71%.

Significant Increases in Housing Supply

13. The revisions to the ABSD rates to help moderate investment demand will complement our efforts to ramp up supply, to alleviate the tight housing market for both owner-occupation and rental.

14. We have increased the supply of private housing on the Confirmed List to 4,100 units for the 1H2023 Government Land Sales (GLS) programme, from 3,500 units for 2H2022. In 2022, we had injected a total of 6,300 units under the Confirmed List. For public housing, we have launched more than 23,000 flats in 2022 and will launch up to 23,000 flats in 2023. We are also prepared to launch up to 100,000 new flats in total between 2021 to 2025. We will continue to maintain a steady pipeline, to cater to growing housing demand.

15. While COVID-19 had led to severe delays across private and public housing projects, we have made good progress to get back on track. With almost 40,000 public and private residential property completions in 2023, and near 100,000 units expected to be completed from 2023 to 2025, there will be significant housing supply coming onstream over the next few years.

16. The property cooling measures above have been calibrated to moderate housing demand while prioritising owner-occupation, and provide sufficient housing supply. The Government will continue to adjust our policies as necessary to ensure that they remain relevant, and promote a sustainable property market.

Issued by:

Source : Ministry of Finance, Ministry of National Development and Monetary Authority of Singapore

Buyer’s Stamp Duty (BSD) Rates to be Raised for Higher-Value Properties

14 February, 2023

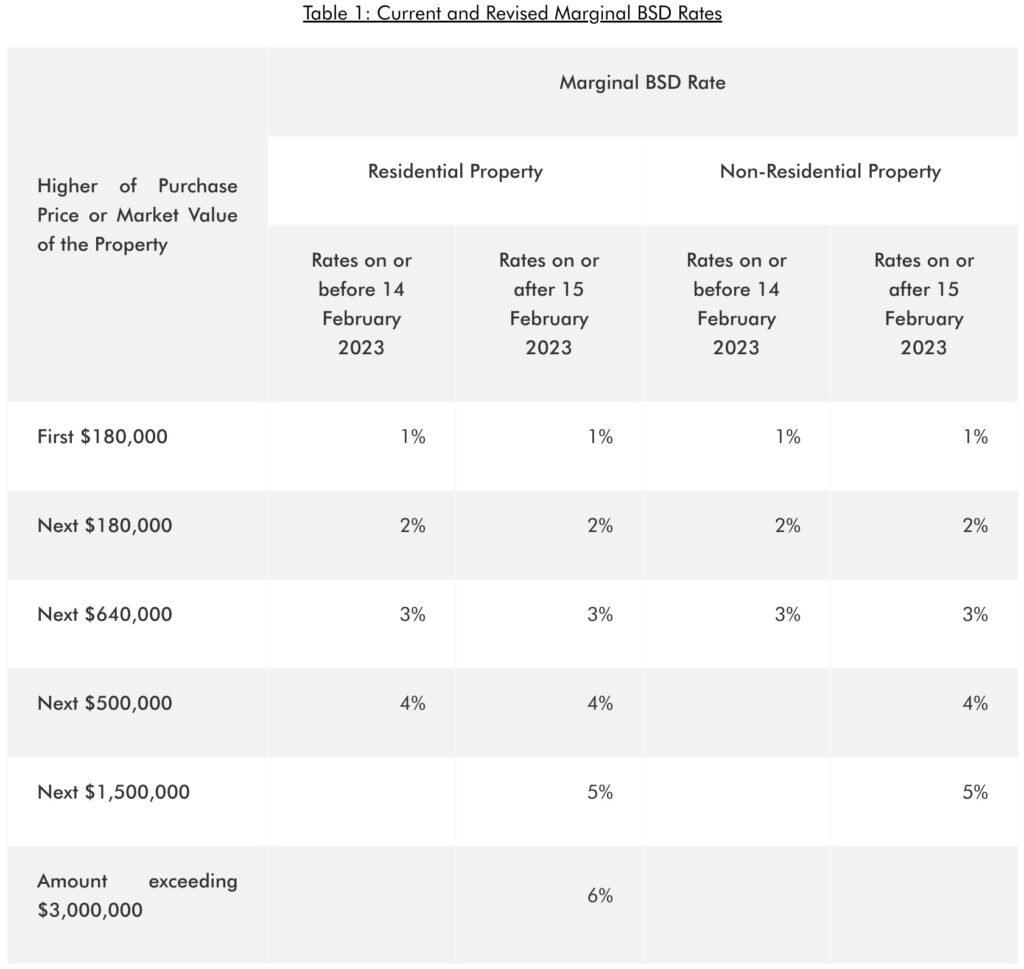

The Government announced today that the top marginal Buyer’s Stamp Duty (BSD) rate for residential and non-residential properties will be raised to enhance the progressivity of the BSD regime.

2. For residential properties, the portion of the value of the property in excess of $1.5 million and up to $3 million will be taxed at 5%, while that in excess of $3 million will be taxed at 6%; up from the current rate of 4%.

3. For non-residential properties, the portion of the value of the property in excess of $1 million and up to $1.5 million will be taxed at 4%, while that in excess of $1.5 million will be taxed at 5%; up from the current rate of 3%.

4. The revised BSD rates will apply to all properties acquired on or after 15 February 2023. Table 1 summarises the adjustments to the BSD rates.

5. There will be a transitional provision, where the BSD rates on or before 14 February 2023 will apply for cases that meet all the conditions below:

a) The Option to Purchase (OTP) was granted by sellers to potential buyers on or before 14 February 2023;

b) This OTP is exercised on or before 7 March 2023, or within the OTP validity period, whichever is earlier; and

c)This OTP has not been varied on or after 15 February 2023.

6. Correspondingly, the Additional Conveyance Duties for Buyers (ACDB), which applies to qualifying acquisitions of equity interest in property holding entities (PHEs[1]), will be raised from up to 44% to up to 46%.

7. For more information, please visit www.iras.gov.sg.

Issued by:

Ministry of Finance

Singapore

14 February 2023

source: [ link ]

Joint MAS-MND-HDB Press release: Measures to promote sustainable conditions in the property market by ensuring prudent borrowing and moderating demand

Sep 29, 2022

1. Market interest rates have risen significantly. They are likely to increase further in future, which will affect borrowing costs for home purchases. To ensure prudent borrowing and avoid future difficulties in servicing home loans, the Government will tighten the maximum loan quantum limits for housing loans.

a. First, we will assume higher interest rates when assessing borrowers’ repayment ability via the following two measures:

i. For property loans granted by private financial institutions, MAS will raise by 0.5%-point the medium-term interest rate floor used to compute the Total Debt Servicing Ratio (TDSR) and Mortgage Servicing Ratio (MSR).

- This will apply to loans for the purchase of properties where the Option to Purchase (OTP) is granted on or after 30 September 2022, or where there is no OTP, the date of the Sale and Purchase Agreement is on or after 30 September 2022.

- The actual interest rates charged for mortgages will continue to be determined by the private financial institutions.

ii. For housing loans granted by HDB, HDB will introduce an interest rate floor of 3% for computing the eligible loan amount.

- The interest rate floor will apply to fresh applications for an HDB Loan Eligibility (HLE) letter received on or after 30 September 2022, 00:00 hours.

- There will be no impact to existing HLE applications received by HDB before this time.

- This will not affect the actual HDB concessionary interest rate, which will remain unchanged at 2.6% p.a..

b. Second, we will lower the Loan-to-Value (LTV) limit for HDB housing loans from 85% to 80%. The lower LTV limit will apply to new flat applications for sales exercises launched and complete resale applications which are received by HDB on or after 30 September 2022.

2. To moderate demand in the HDB resale market, we will impose a wait-out period of 15 months for private residential property owners (PPOs) and ex-PPOs[1] to buy a non-subsidised HDB resale flat. The wait-out period will not apply to seniors aged 55 and above who are moving from their private property to a 4-room or smaller resale flat. This new property cooling measure will take effect from 30 September 2022. It is a temporary measure which will be reviewed in future depending on overall market conditions and housing demand.

3. More details are set out below.

Measures to Ensure Prudent Borrowing Amid Rising Interest Rates

Higher Medium-Term Interest Rate Floor to Compute TDSR and MSR

4. MAS will raise by 0.5%-point the medium-term interest rate floor used by private financial institutions to compute a borrower’s TDSR and MSR. This revision reflects higher interest rates expected over the medium term, compared to the period of exceptionally low rates from 2013 to 2021. The new medium-term interest rates are:

Type of loan | Medium-term interest rate |

Residential property purchase loans and mortgage equity withdrawal loans | The higher ofa 4% per annum (p.a.)floor (up from 3.5% p.a.) or the thereafter interest rate*. |

Non-residential property purchase loans and mortgage equity withdrawal loans | The higher ofa 5% p.a. floor (up from 4.5% p.a.)or the thereafter interest rate. |

*The thereafter interest rate is the highest possible interest rate applicable during the tenure of a property loan, excluding introductory or promotional rates.

5. Mortgage interest rates pegged to the 3-Month Compounded Singapore Overnight Rate Average (SORA) have been rising in the past months. They are expected to rise further in 2023 along with US interest rates, before settling at a higher level compared to the lows during the period 2013 to 2021.

6. The revised medium-term rate floors ensure that households borrow prudently for their property purchases in a higher interest rate environment. This is necessary as property loans are long-term commitments and are often the households’ largest liability. Some borrowers may need to right-size their intended property loans but will be better able to service these loans when interest rates rise.

7. The revised medium-term interest rate floors will apply to loans for the purchase of properties where the Option to Purchase (OTP) is granted on or after 30 September 2022, or where there is no OTP, the date of the Sale and Purchase Agreement is on or after 30 September 2022. It will also apply to new mortgage equity withdrawal loan applications made on or after 30 September 2022. Borrowers refinancing owner-occupied property loans will not be affected by this change, while those refinancing other types of property loans will be subject to the prevailing medium-term interest rate that applied when they first took up their loans.

Interest Rate Floor to Compute Eligible Loan Amount from HDB

8. In tandem with the increase in the medium-term interest rate floor in the TDSR and MSR framework, HDB will introduce an interest rate floor of 3% p.a. to compute a borrower’s eligible housing loan amount[2]. This means that the interest rate used to compute the eligible loan amount for HDB’s concessionary housing loan will be the higher of 3% p.a. or 0.1%-point above the prevailing CPF Ordinary Account (OA) interest rate. HDB’s use of the interest rate floor to compute the housing loan amount encourages flat buyers to borrow prudently as purchasing a flat is a long-term financial commitment.

9. There is no change to the actual interest rate charged for housing loans provided by HDB. The HDB concessionary interest rate is reviewed quarterly, and will continue to be pegged at 0.1%-point above the prevailing CPF OA interest rate. It will remain at 2.6% p.a. from 1 October to 31 December 2022.

10. The interest rate floor to compute the eligible loan amount will take effect as follows:

Transaction Type | Effective Date |

Purchase of flats from HDB in |

on or after 30 Sep 2022, 00:00hr |

Purchase of resale flats on the | HLE letter application received on or after 30 Sep 2022, 00:00hr |

Taking over of ownership of existing flat | HLE letter application received on or after 30 Sep 2022, 00:00hr |

11. The LTV limit for HDB housing loans will be lowered by 5%-points from 85% to 80%. The revised LTV limit will apply to new flat applications for sales exercises launched and complete resale applications[3] which are received by HDB on or after 30 September 2022. The revised LTV limit does not apply to loans granted by private financial institutions, for which the LTV limit remains at 75%.

12. This is not expected to affect first-timer and lower-income flat buyers significantly, as they may receive significant housing grants of up to $80,000 when buying a subsidised flat directly from HDB, or up to $160,000 when buying a resale flat. They can also tap on their CPF savings to pay for the flat purchase, thereby reducing the loan amount they may need to take.

Measures to Moderate Demand and Ensure that HDB Resale Flats Remain Affordable

13. Since the Government implemented a broad package of measures in December 2021, the HDB Resale Price Index has increased by more than 5% as at end-2Q 2022, reflecting a broad-based increase in public housing demand. Given the clear upward momentum in HDB resale prices, MND and HDB will introduce a wait-out period of 15 months for private residential property owners (PPOs) and ex-PPOs to buy a non-subsidised HDB resale flat as a temporary measure to moderate demand and ensure that resale flats remain affordable for flat buyers, especially for first-timers.

14. PPOs and ex-PPOs are currently allowed to buy a non-subsidised HDB resale flat on the open market, with the requirement that they dispose of their private properties within six months of the HDB flat purchase. They will now be required to serve a wait-out period of 15 months after the disposal of their private properties before they are eligible to buy a non-subsidised resale flat. This is a temporary measure to moderate demand for resale flats, which we will review depending on overall demand and market changes. The wait-out period for PPOs who are first-timers and wish to apply for the CPF Housing Grant and Enhanced CPF Housing Grant for their resale flat purchase, remains unchanged at 30 months.

15. We recognise that some seniors may wish to move from their private residential property to an HDB flat, to strengthen their retirement adequacy. To support them, the 15-month wait-out period will not apply to seniors aged 55 and above (and their spouses) who are moving from their private property to a 4-room or smaller resale flat. Senior PPOs/ex-PPOs can continue to buy a 2-room Flexi flat on short lease (if they are aged 55 and above) and Community Care Apartment (if they are aged 65 and above) from HDB.In addition, PPOs/ex-PPOs, regardless of age, with extenuating circumstances, e.g. financial difficulties, may approach HDB for assistance, and we will assess their situation on a case-by-case basis.

16. The Government remains committed to keep public housing inclusive, affordable and accessible to Singaporeans.We will continue to monitor the property market and adjust our policies to ensure that they remain relevant.

17. We urge households to exercise prudence before taking up any new loans, and be sure of their debt-servicing ability before making long-term financial commitments.

Issued by: Housing & Development Board, Ministry of National Development and Monetary Authority of Singapore

source: [ link ]

MEASURES TO COOL THE PROPERTY MARKET

1. The Government announced today a package of property cooling measures to cool the private residential and HDB resale markets. With effect from 16 December 2021, Additional Buyer’s Stamp Duty (ABSD) rates will be raised, and the Total Debt Servicing Ratio (TDSR) threshold will be tightened. The Government will also tighten the LTV limit for loans from HDB from 90% to 85%. In addition, the Government will increase public and private housing supply to cater to demand.

2. The Government has been closely monitoring the property market for several quarters. The private residential and HDB resale markets have been buoyant, despite the economic impact of COVID-19. Private housing prices have risen by about 9% since 1Q2020. HDB resale flat prices are also recovering sharply after a six-year decline, rising about 15% since 1Q 2020. Even though House Price-to-Income ratios remain below their historical averages, there is clear upward momentum. Amid the low interest rate environment, transaction volumes in the private housing market and HDB resale market have also been high despite the COVID-19 situation.

3. If left unchecked, prices could run ahead of economic fundamentals, and raise the risk of a destabilising correction later on. Borrowers would also be vulnerable to a possible rise in interest rates in the coming years.

4. The Government has therefore decided to implement a set of property cooling measures to cool the private and public housing markets, to promote continued housing affordability. The private residential measures are calibrated to dampen broad-based demand, especially from those purchasing property for investment rather than owner occupation. Measures to tighten financing conditions for both public and private housing will encourage greater financial prudence. The Government will also be ramping up the supply for both private and public housing.

Measures Applicable to All Residential Property

Raising Additional Buyer’s Stamp Duty (ABSD) Rates

5. The current ABSD rates for Singapore Citizens (SCs) and Singapore Permanent Residents (SPRs) purchasing their first residential property will remain at 0% and 5% respectively.

6. The Government will raise the ABSD rates as follows:

a. Raise ABSD rate to 17% for SCs purchasing their 2 nd residential property;

b. Raise ABSD rate to 25% for SCs purchasing their 3rd and subsequent residential property, and SPRs purchasing their 2nd residential property;

c. Raise ABSD rate to 30% for SPRs purchasing their 3rd and subsequent residential property and foreigners purchasing any residential property;

d. Raise ABSD rate to 35% for entities purchasing any residential property; and

e. Raise ABSD rate to 35% for developers purchasing any residential property. This 35% may be remitted under the Stamp Duties (Nonlicensed Housing Developers) (Remission for ABSD) Rules and the Stamp Duties (Housing Developers) (Remission of ABSD) Rules, subject to conditions. In addition to this 35% ABSD rate, the non-remittable component remains unchanged at 5%.

7. Table 1 summarises the adjustments to the ABSD rates. Table 1: Adjustments to ABSD Rates for Residential Property

8. For purchases made jointly by two or more parties of different profiles, the highest applicable ABSD rate will apply.

9. Married couples with at least one SC spouse, who jointly purchase a second residential property, can continue to apply for a refund of ABSD, subject to conditions. These conditions include selling their first residential property within 6 months after (a) the date of purchase of the second residential property if this is a completed property, or (b) the issue date of the Temporary Occupation Permit (TOP) or Certificate of Statutory Completion (CSC) of the second residential property, whichever is earlier, if the second property is not completed at the time of purchase.

10. The ABSD currently does not affect those buying an HDB flat or EC unit from property developers with an upfront remission, if any of the joint acquirers/purchasers is a SC. There will be no change to this.

11. The revised ABSD rates will apply to cases where the Option to Purchase (OTP) is granted on or after 16 December 2021. There will be a transitional provision where ABSD rates before 16 December 2021 will apply for cases that meet all of the following conditions:

a. The OTP is granted by sellers to potential buyers on or before 15 December 2021;

b. This OTP is exercised on or before 5 January 2022, or within the OTP validity period, whichever is earlier; and

c. This OTP has not been varied on or after 16 December 2021.

12. Correspondingly, the Additional Conveyance Duties for buyers of equity interest property-holding entities will be raised from up to 34% to up to 44% (increase by 10%- points).

Tightening of Total Debt Servicing Ratio Threshold (TDSR)

13. The TDSR threshold will be tightened by 5%-points from 60% to 55%. The revised TDSR threshold will apply to loans for the purchase of properties where the OTP is granted on or after 16 December 2021, and for mortgage equity withdrawal loan applications made on or after 16 December 2021. Borrowers with existing property loans granted before 16 December 2021 will not be affected by the revised TDSR threshold when refinancing their loans.

Measure Specific to Public Housing

Tightening of Loan-to-Value (LTV) Limit

14. The LTV limit for HDB housing loans will be tightened by 5%-points from 90% to 85%. The revised LTV limit does not apply to loans granted by financial institutions, for which the LTV limit remains at 75%.

15. The LTV limit of 85% will apply to new flat applications for sales exercises launched after 16 December 2021, and complete resale applications which are received by HDB from 16 December 2021 onwards.

Increasing housing supply

16. The Government will also increase the supply of both public and private housing to meet housing demand. Details will be provided tomorrow.

17. The measures undertaken in this cooling package will help promote a stable and sustainable property market. The Government remains vigilant to the risk of a sustained increase in prices relative to income trends.

Issued by: Ministry of Finance, Ministry of National Development and Monetary Authority of Singapore.

15 December 2021

source: [ link ]

Raising Additional Buyer’s Stamp Duty Rates and Tightening Loan-to-Value Limits to Promote a Stable and Sustainable Property Market

Singapore, 5 July 2018

The Government announced today adjustments to the Additional Buyer’s Stamp Duty (ABSD) rates and Loan-to-Value (LTV) limits on residential property purchases, to cool the property market and keep price increases in line with economic fundamentals.

Status of the Private Housing Market

2. After declining gradually for close to 4 years, private residential prices began rising in 3Q2017. Prices have increased sharply by 9.1% over the past year. Demand for private residential property has also seen a strong recovery, as transaction volumes continue to rise.

3. The sharp increase in prices, if left unchecked, could run ahead of economic fundamentals and raise the risk of a destabilising correction later, especially with rising interest rates and the strong pipeline of housing supply.

4. The Government has therefore decided to raise ABSD rates and tighten LTV limits for residential property purchases.

Raising ABSD Rates

5. The current ABSD rates for Singapore Citizens (SC) and Singapore Permanent Residents (SPR) purchasing their first residential property will be retained at 0% and 5% respectively.

6. The Government will make the following changes to ABSD rates:

a. Raise ABSD by 5% points for all other individuals; and

b. Raise ABSD by 10% points for entities; and

c. Introduce an additional ABSD of 5% that is non-remittable under the Remission Rules1 (payable on the purchase price or market value, as applicable) for developers purchasing residential properties for housing development.

7. Table 1 summarises the adjustments to the ABSD rates.

Table 1: Adjustments to ABSD Rates for Residential Property

| Rates on or before 5 July 2018 | Rates on or after 6 July 2018 | |

| SCs buying first residential property | 0% | 0% (No change) |

| SCs buying second residential property | 7% | 12% (Revised) |

| SCs buying third and subsequent residential property | 10% | 15% (Revised) |

| SPRs buying first residential property | 5% | 5% (No change) |

| SPRs buying second and subsequent residential property | 10% | 15% (Revised) |

| Foreigners buying any residential property | 15% | 20% (Revised) |

| Entities buying any residential property | 15% | 25% (Revised)# |

| Plus additional 5% for developers^ (New, non-remittable)* |

# As entities, developers will also be subject to the ABSD rate of 25% for entities. Developers may apply for remission of this 25% ABSD, subject to conditions (including completing and selling all units within the prescribed periods of 3 years or 5 years for non-licensed and licensed developers respectively). Details are provided under the Stamp Duties (Non-licensed Housing Developers) (Remission of ABSD) Rules and the Stamp Duties (Housing Developers) (Remission of ABSD) Rules.

^ Developers refer to entities which engage in the business of construction and sale of housing units.

* This new 5% ABSD for developers is in addition to the 25% ABSD for all entities. This 5% ABSD will not be remitted, and is to be paid upfront upon purchase of residential property.

8. For purchases made jointly by two or more parties of different profiles, the highest applicable ABSD rate will apply. However, full ABSD remission will continue to be provided for joint purchases of the first residential property by married couples with at least one SC spouse.

9. Married couples with at least one SC spouse, who jointly purchase a second residential property, can continue to apply for a refund of ABSD, as long as they sell their first residential property within 6 months after (a) the date of purchase of the second residential property, or (b) the issue date of the Temporary Occupation Permit (TOP) or Certificate of Statutory Completion (CSC) of the second residential property, whichever is earlier (if the property was uncompleted at the time of purchase).

10. There will be a transitional provision for cases where an Option to Purchase (OTP) has been granted by sellers to potential buyers on or before 5 July 2018, and this OTP has not been varied on or after 6 July 2018. For such cases, the current ABSD rates, instead of the revised ABSD rates, will apply if the OTP is exercised within 3 weeks of this announcement (i.e. exercised on or before 26 July 2018) or the OTP validity period, whichever is earlier.

Tightening of LTV Limits

11. LTV limits will be tightened by 5% points for all housing loans granted by financial institutions. These revised LTV limits do not apply to loans granted by HDB. Table 2 summarises the adjustments to the LTV limits:

Table 2: Revised LTV Limits on Housing Loans Granted by Financial Institutions

| 1st Housing Loan | 2nd Housing Loan | From 3rd Housing Loan | |

| Individual Borrowers | |||

| LTV Limit | Existing Rules 80%; or 60% if the loan tenure is more than 30 years* or extends past age 65 Revised Rules 75%; or 55% if the loan tenure is more than 30 years* or extends past age 65 | Existing Rules 50%; or 30% if the loan tenure is more than 30 years* or extends past age 65 Revised Rules 45%; or 25% if the loan tenure is more than 30 years* or extends past age 65 | Existing Rules 40%; or 20% if the loan tenure is more than 30 years* or extends past age 65 Revised Rules 35%; or 15% if the loan tenure is more than 30 years* or extends past age 65 |

| Minimum Cash Down Payment | No change to existing rules | ||

| 5%; or 10% if the loan tenure is more than 30 years* or extends past age 65 | 25% | ||

| Non-Individual Borrowers | |||

| LTV Limit | Existing Rule Revised Rule | ||

* 25 years, where the property purchased is a HDB flat.

12. The tightened LTV limits will apply to loans for the purchase of residential properties where the OTP is granted on or after 6 July 2018.

13. In line with the tightening of LTV limits for housing loans, LTV limits for mortgage equity withdrawal loans (MWLs) will be tightened as follows:

a. 75% for a borrower with no outstanding housing loan for the purchase of another residential property; and

b. 45%for a borrower with an outstanding housing loan for the purchase of another residential property.

14. The tightened LTV limits will apply to MWL applications made on or after 6 July 20182.

15. The Government will continue to monitor the property market and adjust our policies as necessary, to maintain a stable and sustainable property market.

Issued by: Ministry of Finance, Ministry of National Development and Monetary Authority of Singapore

1 Stamp Duties (Non-licensed Housing Developers) (Remission of ABSD) Rules and Stamp Duties (Housing Developers) (Remission of ABSD) Rules

2 For refinancing of existing MWLs, the current LTV limits of 80%, or 60% (for borrowers with an outstanding housing loan for the purchase of another residential property), will continue to apply. Existing MWLs refer to those which were applied before 6 July 2018.

source: [ link ]

Joint Press Release on Measures Relating to Residential Property

Singapore, 10 March 2017

The Government has continued to review conditions in the residential property market. It has determined that the current set of property market measures remain necessary to promote a sustainable residential property market and financial prudence among households. However, we will make calibrated adjustments to the Seller’s Stamp Duty (SSD) and Total Debt Servicing Ratio (TDSR) framework, with effect from 11 March 2017.

Additional Buyer’s Stamp Duties (ABSD) and Loan to Value (LTV) Limits

2. Transaction volumes in the private residential property market remain healthy. There is firm demand for private housing, in part because of current low interest rates and continued income growth. While the growth in outstanding housing loans has moderated, it is prudent for households to further build up their financial buffers to protect against future interest rate increases or any losses in income. The Government is therefore retaining the current ABSD rates and LTV limits.

Seller’s Stamp Duties (SSD)

3. The SSD is currently payable by those who sell a residential property within 4 years of purchase, at rates of between 4% and 16% of the property’s value1. The number of property sales within the 4-year window has fallen significantly over the years since this measure was introduced. The Government will therefore revise the SSD as follows:

a) Impose SSD on holding periods of up to 3 years, down from the current 4 years; and

b) Lower the SSD rate by four percentage points for each tier. The new SSD rates will range from 4% (for properties sold in the third year) to 12% (for those sold within the first year).

4. The new SSD rates will apply to all residential property purchased on and after 11 March 2017. Details of the revised SSD rates are in the Annex.

Total Debt Servicing Ratio (TDSR)

5. The TDSR framework aims to encourage prudent borrowing by households and strengthen credit underwriting standards by financial institutions. Under this framework, property loans extended by a financial institution should not exceed a TDSR threshold of 60%.

6. However, some borrowers have given feedback that the TDSR framework has limited their flexibility to monetise their properties in their retirement years, i.e. to borrow against the value of their properties to obtain additional cash. MAS will therefore relax the rules to meet such needs. We will no longer apply the TDSR framework to mortgage equity withdrawal loans with LTV ratios of 50% and below.

Stamp Duties on Transfer of Equity Interest in Entities whose Primary Tangible Assets Are Residential Properties in Singapore

7. The 2nd Minister for Finance will be introducing legislative changes in Parliament today aimed at treating transactions in residential properties on the same basis irrespective of whether the properties are transacted directly or through a transfer of equity interest in an entity holding residential properties. The intent is not to impact the ordinary buying and selling of shares in such entities by retail investors, where the entities are listed on the Singapore Stock Exchange. However, significant owners of residential property-holding entities or PHEs2 will be subject to the usual stamp duties when they transfer equity interest in such entities, similar to what would happen if they were to buy or sell the properties directly.

8. The Stamp Duties (Amendment) Bill will be tabled in Parliament today to give effect to this policy intent. Further details of this measure are in the Bill.

****

1 Refers to the property’s selling price or market value.

2 An entity is defined as a Property Holding Entity (PHE) under two possible circumstances.

a) The first category of entities holds residential properties directly. To establish if such an entity is a PHE, a significant asset test will be applied. An entity can be a PHE if 50% or more of its total tangible assets is residential properties in Singapore. We will call this a Type 1 PHE.

b) There is also a second category of entities that have indirect holdings of residential property through Type 1 PHEs in which it has at least 50% equity interest. For such an entity, it will be considered as a PHE if it meets two criteria:

i. First, it beneficially owns at least 50% equity interest in a Type 1 PHE, and

ii. Second, it meets the significant asset test as mentioned above – in other words, the total value of the residential property it owns indirectly through Type 1 PHEs in which it owns at least 50% equity interest as well as the value of the property which it may own directly comprises 50% or more of its total tangible assets. Its total tangible assets comprise the total tangible assets it owns directly, as well as through entities (whether PHEs or not) in which it owns at least 50%} equity interest.

source: link

MAS Introduces Debt Servicing Framework for Property Loans

Singapore, 28 June 2013

The Monetary Authority of Singapore (MAS) will introduce a Total Debt Servicing Ratio (TDSR) framework for all property loans granted by financial institutions (FIs) to individuals1. This will require FIs to take into consideration borrowers’ other outstanding debt obligations when granting property loans. They will help strengthen credit underwriting practices by FIs and encourage financial prudence among borrowers.

2 MAS will also refine rules related to the application of the existing Loan-to-Value (LTV) limits on housing loans. These refinements seek to ensure the effectiveness of the LTV limits that were put in place to cool investment demand in the housing market. In particular, they aim to prevent circumvention of the tighter LTV limits on second and subsequent housing loans.

Introduction of TDSR framework

3 MAS conducted a thematic inspection of banks’ residential property loan portfolios in 2012. While banks generally had in place sound policies to assess the credit worthiness of borrowers, the inspection and subsequent surveys revealed uneven practices with respect to the application of debt servicing ratios and highlighted areas for improvement in credit underwriting practices.

4 The TDSR framework will provide FIs a robust basis for assessing the debt servicing ability of borrowers applying for property loans, taking into consideration their other outstanding debt obligations. FIs will be required to compute the TDSR, or the percentage of total monthly debt obligations to gross monthly income, on a consistent basis.2

5 The coverage of the TDSR framework will be more comprehensive than FIs’ current practice. The TDSR will apply to loans for the purchase of all types of property, loans secured on property,3 and the re-financing of all such loans.4

6 The methodology for computing the TDSR will be standardised. FIs will be required to:

- take into account the monthly repayment for the property loan that the borrower is applying for plus the monthly repayments on all other outstanding property and non-property debt obligations of the borrower;

- apply a specified medium-term interest rate or the prevailing market interest rate, whichever is higher, to the property loan that the borrower is applying for when calculating the TDSR;5

- apply a haircut of at least 30% to all variable income (e.g. bonuses) and rental income; and

- apply haircuts6 to and amortise the value of any eligible financial assets taken into consideration in assessing the borrower’s debt servicing ability, in order to convert them into ‘income streams’ in computing the TDSR.

7 FIs will be required to verify and obtain relevant documentation on a borrower’s debt obligations and income used in the computation of the TDSR.

8 MAS expects any property loan extended by the FI to not exceed a TDSR threshold of 60% and will regard any property loan in excess of a 60% TDSR to be imprudent.7 The threshold is set at 60% for a start to allow both the FIs and borrowers to familiarise themselves with the TDSR framework and its computation methodology. MAS will monitor and review the 60% threshold over time, with a view to further encouraging financial prudence.

Refinement of rules related to application of LTV limits

9 MAS will refine certain rules related to the application of the existing LTV limits on housing loans granted by FIs. In particular, MAS will require:

- borrowers named on a property loan to be the mortgagors of the residential property for which the loan is taken;

- “guarantors” who are standing guarantee for borrowers otherwise assessed by the FI at the point of application for the housing loan not to meet the TDSR threshold for a property loan to be brought in as co-borrowers; and

- in the case of joint borrowers, that FIs use the income-weighted average age of borrowers8 when applying the rules on loan tenure.9

Measures for the long term

10 The new rules will take effect from 29 June 2013.

11 The TDSR framework and refinements to the rules relating to the application of LTV limits are structural in nature, and will be in place for the long term. They aim to encourage prudent borrowing by households and strengthen credit underwriting standards by FIs.

12 They do not involve changes to the LTV limits on housing loans themselves, which were last tightened in January 2013 as part of the government’s package of measures to promote stable and sustainable conditions in the housing market.10The current LTV limits are not permanent, and will be reviewed depending on the state of the property market.

13 Please refer to the FAQs on MAS’ website for further details.

***

1 This includes sole proprietorships and vehicles set up by an individual solely to purchase property.

2 In the case of a joint application for a property loan, the TDSR shall be computed based on the aggregate total monthly debt obligations and aggregate gross monthly incomes of the joint borrowers.

3 Where a loan is secured by a pool of collateral including property, the TDSR rules will apply if the market value of the property is 50% or more of the value of the total pool of collateral.

4 Existing borrowers who are seeking to refinance their housing loans will be exempted, provided they meet the specific conditions set out in MAS’ Guidelines on the Application of TDSR for Property Loans under MAS Notices 645, 1115, 831 and 128.

5 3.5% for housing loans and 4.5% for non-residential property loans.

6 Eligible liquid assets which are pledged for at least 4 years with the FI from which the borrower is taking the property loan will not be subject to any haircut.

7 Property loans in excess of the TDSR threshold of 60% should be granted only on an exceptional basis. The board of directors of the FI (or senior management in the case of an FI incorporated outside of Singapore) will have to approve policies and procedures relating to such exceptions. In addition, cases exceeding the threshold will need to be approved by the FI’s credit committee.

8 The income-weighted average age will be based on the borrowers’ gross monthly income.

9 Lower LTV limits apply to a loan granted for the purchase of a residential property, where the loan period extends beyond the retirement age of 65 years or the tenure exceeds 30 years.

10 In January 2013, MAS lowered the LTV limits for housing loans to individuals with one outstanding housing loan from 60% to 50%, and to individuals with two or more outstanding housing loans from 60% to 40%. Loans with longer tenure faced even tighter LTV limits. The LTV limit for housing loans to non-individuals was also reduced to 20%.

source: link

Additional Measures To Ensure A Stable And Sustainable Property Market

Singapore, 11 January 2013

JOINT PRESS RELEASE

1 The Government announced today a comprehensive package of measures to cool the residential property market. It also introduced a Seller’s Stamp Duty on industrial properties for the first time, to discourage speculative activity in the industrial market.

Cooling Measures for the Residential Property Market

2 The Government has implemented several rounds of property cooling measures to cool demand and expand supply, so as to moderate the increase in housing prices. While these measures have dampened speculative buying, the demand for residential property remains firm and prices have continued to rise.

3 The continued buoyancy of the property market reflects the very low interest rate environment and continued income growth in Singapore. These factors supported a record level of housing transactions last year, particularly from investment demand. Housing prices have also shown signs of reaccelerating in recent months, in both the private residential and HDB resale flat markets. Price increases, if not checked, will run further ahead of economic fundamentals and raise the risk of a major, destabilising correction later on.

4 The Government has therefore decided to implement a further set of property cooling measures to cool the private and public housing markets. These measures are calibrated to be tighter on property ownership for investment, as well as on foreign buyers. To discourage over-borrowing, financing conditions for housing have also been tightened. In addition, structural measures have been implemented to strengthen the policy intent of public housing and executive condominiums.

5 Deputy Prime Minister and Minister for Finance Mr Tharman Shanmugaratnam said: “The reality we face is that interest rates are extraordinarily low, globally and in Singapore, and continue to add fuel to our property market. We have to take this further round of measures now, to check recent market trends and avoid a more serious correction in prices further down the road.”

6 Minister for National Development Mr Khaw Boon Wan said: “A large supply of public and private housing – up to 200,000 units in total – will be completed in the coming years. Coupled with the new measures, we will be better placed to ensure that housing remains affordable to Singaporeans.”

Measures Applicable to all Residential Property

7 The following measures will take effect on 12 January 2013:

a) Additional Buyer’s Stamp Duty (ABSD) rates will be:

i) Raised between five and seven percentage points across the board.

ii) Imposed on Permanent Residents (PRs) purchasing their first residential property and on Singaporeans purchasing their second residential property.

b) Loan-to-Value limits on housing loans granted by financial institutions1 will be tightened for individuals who already have at least one outstanding loan, as well as to non-individuals such as companies.

c) Besides tighter Loan-to-Value limits, the minimum cash down payment for individuals applying for a second or subsequent housing loan will also be raised from 10% to 25%.

8 The measures listed above will not impact most Singaporeans buying their first home. Some concessions will also be extended to selected groups of buyers, such as married couples with at least one Singaporean spouse who are purchasing their second property and will sell their first residential property.

9 These new ABSDs and loan rules are significant, but they are temporary. They are being imposed to cool the market now, and will be reviewed in future depending on market conditions.

10 The details of the ABSD measure are set out in Annex I, and the housing loan measures, in Annex II.

Measures Specific to Public Housing

11 The Government is also introducing measures to further moderate the demand for HDB flats, instil greater financial prudence among buyers, and require owner occupation by PR buyers. The following measures will take effect on 12 January 2013:

a) Tighter eligibility for loans to buy HDB flats:

i) MAS will cap the Mortgage Servicing Ratio (MSR) for housing loans granted by financial institutions2 at 30% of a borrower’s gross monthly income3 .

ii) For loans granted by HDB, the cap on the MSR will be lowered from 40% to 35%.

b) PRs who own a HDB flat will be disallowed from subletting their whole flat.

c) PRs who own a HDB flat must sell their flat within six months of purchasing a private residential property in Singapore.

Details of these measures are in Annex III.

12 An additional measure will take effect on 1 July 2013 to tighten the terms for granting HDB loans and the use of CPF funds for the purchase of HDB flats with remaining leases of less than 60 years (details of this measure are in Annex IV).

Measures for Executive Condominium Developments

13 The Government will introduce measures specific to new EC developments to ensure that ECs continue to serve as an affordable housing option for middle-income Singaporean families.

14 The following measures will take effect on 12 January 2013:

a) The maximum strata floor area of new EC units will be capped at 160 square metres.

b) Sales of new dual-key EC units will be restricted to multi-generational families only.

c) Developers of future EC sale sites from the Government Land Sales programme will only be allowed to launch units for sale 15 months from the date of award of the sites or after the physical completion of foundation works, whichever is earlier.

d) Private enclosed spaces and private roof terraces will be treated as gross floor area (GFA). The GFA of such spaces in non-landed residential developments, including ECs, will be counted as part of the ‘bonus’ GFA of a residential development and subject to payment of charges. This is in line with the treatment of balconies under URA’s current guidelines. Details of this measure are at www.ura.gov.sg/circulars/text/dc13-01.htm.

Cooling Measure for the Industrial Property Market: Seller’s Stamp Duty

15 Prices of industrial properties have doubled over the last three years, outpacing the increase in rentals. In addition, there has been increasing speculation in industrial properties: in 2011 and the first eleven months of 2012, about 15% and 18% respectively of all transactions of multiple-user factory space were resale transactions carried out within three years of purchase. This is significantly higher than the average of about 10% from 2006 to 2010.

16 The Government is introducing Seller’s Stamp Duty (SSD) on industrial property to discourage short-term speculative activity which could distort the underlying prices of industrial properties and raise costs for businesses.

17 The following SSD rates will be imposed on industrial properties and land bought and sold within three years of the date of purchase:

These SSDs will apply for industrial properties and land bought on or after 12 January 2013.

18 The Inland Revenue Authority of Singapore (IRAS) will be releasing an E-tax guide on the circumstances under which SSD is applicable and the procedures for paying SSD. The E-tax guide will be available at www.iras.gov.sg.

Issued by the Ministry of Finance, Ministry of National Development, Monetary Authority of Singapore and Ministry of Trade & Industry

3 Medium-term interest rates shall be used to determine the monthly mortgage instalments from MAS-regulated financial institutions.

source: link

MAS Restricts Loan Tenure for Residential Properties

Singapore, 5 October 2012

The Monetary Authority of Singapore (MAS) will restrict the tenure of loans granted by financial institutions for the purchase of residential properties. MAS’ move is part of the Government’s broader aim of avoiding a price bubble and fostering long term stability in the property market.

2 The maximum tenure of all new residential property loans will be capped at 35 years. In addition, loans exceeding 30 years tenure will face significantly tighter loan-to-value (LTV) limits. This will apply to both private properties and HDB flats. The new rules will take effect from 6 October 2012.

Long tenure loans fuel property prices

3 The new rules aim to curb continued upward pressure on residential property prices, driven by low interest rates and rapid credit growth.

4 Previous rounds of Government property cooling measures have had a moderating effect on residential property prices. There is also significant supply of housing that will come onto the market over the next two years. However, prices in both the HDB resale market and private residential property have continued to rise in Q2 and Q3 of 2012.

5 The current climate of low interest rates, globally and in Singapore, is likely to persist for some time. It will continue to spur demand in the residential property market, pushing up prices beyond sustainable levels. The eventual correction could be painful to borrowers and destabilise the economy.

6 At the same time, financial institutions have been lengthening the tenures of residential property loans. Over the last three years, the average tenure for new residential property loans has increased from 25 to 29 years. More than 45% of new residential property loans granted by financial institutions have tenures exceeding 30 years.

7 Long tenure loans pose risks to both lenders and borrowers. The lower initial monthly repayments, made possible by long loan tenures and the current low interest rates, may lead borrowers to over-estimate their ability to service the loans, and take a bigger loan than they can really afford. A rising property market may give false confidence to both borrowers and lenders that should there be difficulty in servicing the loan they can always sell the property at a higher price. In reality, long tenure loans impose a larger debt repayment burden on borrowers as interest accumulates over a longer period. When interest rates eventually rise, borrowers who have overextended themselves will have difficulties repaying their loans. If property prices fall, financial institutions may be caught holding the bad loans.

8 Mr Tharman Shanmugaratnam, Chairman of MAS, said, “Monetary conditions worldwide are far from normal. QE3 and low interest rates have made credit easy, but this will eventually change. We are taking this step now to require more prudent lending, and will continue to watch the property market carefully. We will do what it takes to cool the market, and avoid a bubble that will eventually hurt borrowers and destabilise our financial system.”

New rules on loan tenure

9 The new MAS rules impose an absolute limit of 35 years on the tenure of all loans for residential property. This will apply to loans to both individual and non-individual borrowers, as well as refinancing loans1, from 6 October 2012.2

10 In addition, MAS will lower the LTV ratio for new residential property loans to borrowers who are individuals, if:

- the tenure exceeds 30 years; or

- the loan period extends beyond the retirement age of 65 years.

For these loans, the LTV limit will be:

- 40% for a borrower with one or more outstanding residential property loans3; and

- 60% for a borrower with no outstanding residential property loan.

11 MAS will also lower the LTV ratio for residential property loans to non-individual borrowers from 50% to 40%.

source: link

Additional Buyer’s Stamp Duty for a Stable and Sustainable Property Market

7 Dec 2011 7.40pm

1 The Government announced today an Additional Buyer’s Stamp Duty (ABSD) to be imposed on certain categories of residential property purchases. The ABSD will be imposed over and above the current Buyer’s Stamp Duty, and will apply to the purchase price or market value of the property (whichever is higher) for the following purchases:

a) Foreigners and non-individuals1 (corporate entities) buying any residential property will pay an ABSD of 10%;

b) Permanent Residents (PRs) owning one2 and buying the second and subsequent residential property will pay an ABSD of 3%; and

c) Singapore Citizens (Singaporeans) owning two2 and buying the third and subsequent residential property will pay an ABSD of 3%.

The ABSD will take effect on 8 Dec 20113. Remission of ABSD will be given for options granted on or before 7 Dec 2011 and exercised within 3 weeks (i.e. on or before 28 Dec 2011) or the option validity period, whichever is the earlier.

2 The Government’s objective is to promote a sustainable residential property market where prices move in line with economic fundamentals. Prices of private residential properties have continued to rise, albeit more slowly in the last two quarters. Prices are now 13% and 16% above the more recent peak in 2Q2008.

3 Even with the current economic uncertainties, the demand for private residential property remains firm. Given the uncertainty in stock markets and with interest rates remaining low, private property in Singapore continues to attract investors, local and foreign. Excessive investment demand will however make the property cycle more volatile, and thus increase the risks to our economy and banking system.

4 The Government has therefore decided to impose the ABSD to moderate investment demand for private residential property and promote a more stable and sustainable market. A higher ABSD rate for foreign buyers in particular is necessary, in view of the large pool of external liquidity and strong buying interest from abroad, and the relatively small size of the Singapore market. Foreign purchases account for 19% of all private residential property purchases in 2H2011, up from 7% in 1H2009.

5 The ABSD will apply in addition to the existing Buyer’s Stamp Duty on property purchases, which are applied at following rates: 1% on first $180,000 of purchase consideration or market value of the property (whichever is higher), 2% on the next $180,000 and 3% for the remainder.

6 For purchases made jointly by two or more parties (e.g. a Singaporean with a PR, or a PR with a foreigner), the higher applicable ABSD rate will be imposed. For example, if a citizen purchases a property with a foreigner, the ABSD of 10% will apply. In the case of a joint purchase by Singaporeans, who each already owns properties, the ABSD of 3% will apply as long as one of the purchasers already owns two properties.

7 Singaporean first time buyers and upgraders, and buyers of HDB flats4 will not be affected by the new property cooling measure. Certain reliefs will be provided so that the measure will not impact home occupation demand by residents. For example, relief will be provided for Singaporean-foreigner/PR married couples buying their homes. Reliefs will also be provided for qualifying developers and for purchases falling within the scope of Singapore’s international trade agreements. More details will be provided on the IRAS website.

Adequate Supply of Private Housing to Meet Demand

8 The Government will also continue to ensure an adequate supply of private housing to meet medium term demand. There are 41,000 unsold private housing units in the pipeline. The Government will inject sites that can potentially yield a total of 14,100 units in the 1H2012 Government Land Sales (GLS) Programme, similar to the supply in previous GLS programmes. Of these, about 7,000 units will be from sites on the Confirmed List. These numbers take into account the ample pipeline supply and the dampening effect of the ABSD.

9 To give more Singaporean households the chance to own or upgrade to private housing, the Government raised the monthly income ceiling for the purchase of new Executive Condominiums (ECs) from $10,000 to $12,000 in Aug 2011. We will expand the EC supply in 2012 and are prepared to release sites that can potentially yield 5,000 EC units for the entire year. Sites for 3,500 EC units will be made available in 1H2012, including 3,000 EC units on the Confirmed List. The Confirmed List quantum is comparable to the 3,000 EC units from 5 sites sold for the whole of 2011. More details will be provided in the press release for the 1H2012 GLS Programme on MND’s website.

10 The Government will continue to monitor the property market and adjust our property policies in step with changes in the market and the economy. Mr Tharman Shanmugaratnam, Deputy Prime Minister and Minister for Finance, said, “We have always had open markets and must keep them that way. However, the reality is that investment flows into our property market are now larger than before, and unlikely to recede as long as interest rates remain low. The additional buyer’s stamp duty should help cool investment demand, and avoid the prospect of a major, destabilising correction further down the road.”

11 Khaw Boon Wan, Minister for National Development, said, “We are ramping up the supply of new EC units through the Government Land Sales Programme. This will help higher-income Singaporeans own private condominium units in an affordable way, as the sale of new EC units is restricted to Singaporean households only.”

Issued by the Ministry of Finance & Ministry of National Development

7 Dec 2011

source: link

Measures to Maintain a Stable and Sustainable Property Market

13 January 2011

1 The Government announced today the following measures to maintain a stable and sustainable property market:

a) Increase the holding period for imposition of Seller’s Stamp Duty (SSD) from the current three years to four years;

b) Raise the SSD rates to 16%, 12%, 8% and 4% of consideration for residential properties which are bought on or after 14 January 2011, and are sold in the first, second, third and fourth year of purchase respectively;

c) Lower the Loan-To-Value (LTV) limit to 50% on housing loans granted by financial institutions regulated by MAS for property purchasers who are not individuals1; and

d) Lower the LTV limit on housing loans granted by financial institutions regulated by MAS from 70% to 60% for property purchasers who are individuals with one or more outstanding housing loans2 at the time of the new housing purchase.

The property cooling measures will take effect on 14 January 2011.

2 The Government’s objective is to ensure a stable and sustainable property market where prices move in line with economic fundamentals. Previous Government measures have to some extent moderated the market, but sentiments remain buoyant. Low interest rates plus excessive liquidity in the financial system, both in Singapore and globally, could cause prices to rise beyond sustainable levels based on economic fundamentals. Moreover, when interest rates eventually rise, it could strain purchasers who have overextended themselves financially. Therefore, the Government has decided to introduce additional targeted measures to cool the property market and encourage greater financial prudence among property purchasers.

Extending the Holding Period for Imposition of Seller’s Stamp Duty (SSD) on Residential Properties from 3 Years to 4 Years & Raising the SSD Rates

3 Currently, for residential properties bought on or after 30 August 2010, SSD3 is imposed on the sale of such properties within three years of purchase. This followed the introduction of SSD for residential properties bought on or after 20 February 2010.

4 The SSD rates will be increased sharply from 14 January 2011, so as to provide a strong disincentive for investors looking to make short term gains. The holding period for imposition of SSD will also be extended from the current three years to four years. The impact of the SSD is especially significant as it is payable regardless whether the property is eventually sold at a gain or loss.

5 Specifically, for residential properties bought4 on or after 14 January 2011, the SSD rates to be levied on the full consideration will be increased5 to as follows:

a) SSD at 16% (higher than up to 3% currently), if the property is sold in the first year of purchase, i.e. the property is held for 1 year or less from its purchase date.

b) SSD at 12% (higher than up to 2% currently), if the property is sold in the second year of purchase, i.e. the property is held for more than 1 year and up to 2 years.

c) SSD at 8% (higher than up to 1% currently), if the property is sold in the third year of purchase, i.e. the property is held for more than 2 years and up to 3 years.

d) SSD at 4% (no SSD currently), if the property is sold in the fourth year of purchase, i.e. the property is held for more than 3 years and up to 4 years.

6 The extended SSD will not affect HDB lessees as the required Minimum Occupation Period for HDB flats is 5 years.

7 IRAS will be releasing an updated e-tax guide on the circumstances under which SSD will apply and the procedures for paying SSD6. The e-tax guide will be available at www.iras.gov.sg. Taxpayers with enquiries may call IRAS at 6351 3697 or 6351 3698.

Lower the Loan-To-Value (LTV) Limit to 50% on housing loans granted by financial institutions regulated by MAS for residential property purchasers who are not individuals

8 With effect from 14 January 20117, an LTV limit of 50% will apply to all residential property purchasers who are not individuals. This includes corporations, trusts and collective investment schemes, among others. The 50% LTV limit for housing loans will also apply to joint property purchases by an individual and a purchaser who is not an individual.

Lower the LTV limit on housing loans granted by financial institutions regulated by MAS from the current 70% to 60% for residential property purchasers who are individuals with one or more outstanding housing loans at the time of the new housing purchase

9 The LTV limit is lowered from 70% to 60% with effect from 14 January 20118 for borrowers who are individuals and have one or more outstanding housing loans (whether from HDB or a financial institution regulated by MAS) at the time of applying for a housing loan for the new property purchase.

10 However, borrowers who can show evidence that they have sold their existing properties will not be subject to the lower LTV limit when they buy a new property. Where the existing property is a private property, he can show a signed Sale & Purchase (S&P) agreement with the IRAS certificate showing that stamp duty has been paid on it. Where the existing property is a HDB flat, he can show HDB’s approval letter to sell the flat, that HDB will issue within 2 weeks of the First Appointment. These borrowers will still be able to borrow at an 80% LTV from financial institutions.

11 Borrowers without any outstanding housing loans continue to have a LTV cap of 80%.

12 These rules apply to housing loans granted by financial institutions for private residential properties, Executive Condominiums, HUDC flats and HDB flats (including DBSS flats).

13 Loans granted by HDB for HDB flats (including DBSS flats) will still have a LTV cap of 90%. HDB loans are offered to eligible Singapore citizens buying their first homes or right-sizing their flats to meet their housing needs. HDB loan applicants are required to utilise all the balance in their CPF Ordinary Account before HDB loans will be granted. Furthermore, those taking a second concessionary HDB loan must use the CPF refund and 50% of the cash proceeds from the sale of their previous flat before they are granted an HDB loan. This is to ensure that eligible buyers, especially first-time buyers, purchase public housing in a financially prudent manner.

Adequate Supply in the Pipeline

14 There is an ample supply of private residential units and buyers need not rush to buy now. The Government will continue to ensure an adequate supply of housing to meet demand.

15 The annual average take-up9 of private residential units between 2007 and 2010 is about 12,700 units. Thus far, the sites awarded under the Government Land Sales (GLS) Programme in 2010 will already yield about 13,300 units. In the GLS Programme for the first half of 2011, we will make available sites that can yield about 14,300 private housing units, of which about 8,100 units will be from sites on the Confirmed List.

16 As at 3Q2010, there were about 64,400 uncompleted units of private housing from projects in the pipeline10. Of these, about 33,800 units were still unsold. This is equivalent to about 3 years of supply based on the average annual take-up over the last 4 years. The 33,800 unsold units in the pipeline comprised 3,300 units that had been launched for sale by developers and 11,400 units which had the pre-requisite conditions for sale11 and could be launched for sale immediately. The remaining 19,100 units with planning approvals did not have the pre-requisite conditions for sale but these could be obtained quickly from the Government12. The Government will also make available more supply in future GLS programmes. Buyers should bear in mind this supply in the pipeline when deciding whether to buy now.

17 The Government will continue to monitor the property market closely and take further steps to promote a stable and sustainable property market if necessary.

Issued by the Ministry of National Development, Ministry of Finance and Monetary Authority of Singapore

1“Purchasers who are not individuals” refer to purchasers who are not natural persons. These include but are not limited to corporations, trusts and collective investment schemes.

2Financial institutions are required to conduct checks with HDB and with one or more credit bureaus on whether the purchaser has an outstanding housing loan at the time of applying for a housing loan for the property purchase. For joint purchasers, if either purchaser has an outstanding housing loan, the joint purchasers will be considered as having an outstanding housing loan.

3The SSD will apply to the transfer or disposal of interest (including sale and gifts) of residential lands and residential units (whether completed or uncompleted).

4The date of purchase for computation of the holding period for SSD shall be the date when a buyer (i.e. Buyer A) exercises the option to purchase the property, or signs the sale and purchase agreement, whichever is earlier. The date of sale of the property shall be the date when the subsequent buyer (i.e. Buyer B) exercises the option to purchase the property from Buyer A, or signs the sale and purchase agreement, whichever is earlier.

5Currently, the SSD rates are levied at the same rate as buyer’s stamp duty, i.e. 1% for the first $180,000, 2% for the next $180,000 and 3% on the balance. The SSD rates are tiered according to the duration of the holding period, i.e. the seller pays the full SSD rate if the residential property is sold in the first year of purchase; 2/3 the full SSD rate if the sale is in the second year; 1/3 the full SSD rate if in the third year.

6SSD is to be paid within 14 days of the execution of the Agreement (i.e. exercise of Option or signing of Agreement). If the Agreement is executed overseas, upon receipt of the Agreement in Singapore, the SSD must be paid within 30 days.

7The 50% LTV limit will apply to transactions where the date on which the option to purchase (OTP) was granted falls on or after 14 January 2011; or if there is no OTP, where the date of the Sale & Purchase agreement falls on or after 14 January 2011.

8The 60% LTV limit will apply to transactions where the date on which the option to purchase (OTP) was granted falls on or after 14 January 2011; or if there is no OTP, where the date of the Sale & Purchase agreement falls on or after 14 January 2011.

9Take-up refers to the number of private residential units, including Executive Condominium (EC) units, sold by developers.

10These refer to new development and redevelopment projects with planning approvals, i.e. either a Provisional Permission (PP) or Written Permission (WP).

11These refer to private residential developments with Housing Developer Licence and Building Plan Approval. Under the Housing Developer (Control and Licensing) Act, a sale licence must be obtained for a project with more than 4 units, if the developer intends to sell uncompleted residential units in the development. However, the sale of the residential units can only commence with the approval of the building plans of the development.

12These refer to uncompleted private residential developments without pre-requisites for sale but with WP or PP granted. The sale licences could be obtained within 5 working days and building plan approvals could be obtained within 7 working days from the date of application for cases where clearances from various technical agencies are obtained and relevant documents are in order during formal submissions.

source: link

Joint Press Release on Measures to Maintain a Stable and Sustainable Property Market

30 August 2010

1) The Government announced today the following measures to maintain a stable and sustainable property market:

a) Increase the holding period for imposition of Seller’s Stamp Duty (SSD) from the current one year to three years.

b) For property buyers who already have one or more outstanding housing loans1 at the time of the new housing purchase:

i. Increase the minimum cash payment from 5% to 10% of the valuation limit2; and

ii. Decrease the Loan-to-Value (LTV) limit for housing loans granted by financial institutions regulated by MAS to these buyers from the current 80% to 70%.

The measures will take immediate effect on 30 August 2010.

2) The Government’s objective is to ensure a stable and sustainable property market where prices move in line with economic fundamentals. The property market is currently very buoyant. While the rate of price increase of private residential properties has moderated in the last 3 quarters, prices have still increased significantly by 11% in the first half of 2010, and price levels have now exceeded the historical peak in the second quarter of 1996.

3) While Singapore has enjoyed strong economic growth in the first half of 2010, our economic growth is expected to moderate in the second half of the year. There are also still uncertainties in the global economy. Should economic growth falter and the market corrects, property buyers could face capital losses, with implications on their own finances and the economy as a whole. Moreover, the current low global interest rate environment will not continue indefinitely, and higher interest rates could have severe implications for buyers who have overextended themselves. Therefore, the Government has decided to introduce additional property cooling measures now to temper sentiments and encourage greater financial prudence among property purchasers.

Extending the Holding Period for Imposition of Seller’s Stamp Duty (SSD) on Residential Properties Sold from 1 Year to 3 Years

4) The Government imposed in February 2010 a seller’s stamp duty (SSD) for sellers who buy residential properties3 on or after 20 February 2010 and sell them within a year of purchase.

5) For residential properties bought4 on or after 30 August 2010, SSD will be imposed if these properties are sold within three years of purchase. Specifically, the SSD levied on residential properties will be revised to as follows:

a) Sold within the first year of purchase, i.e. the property is held for 1 year or less from its purchase date – The full SSD rate (1% for the first $180,000 of the consideration, 2% for the next $180,000, and 3% for the balance) will be imposed.

b) Sold within the second year of purchase, i.e. the property is held for more than 1 year and up to 2 years – 2/3 of the full SSD rate.

c) Sold within the third year of purchase, i.e. the property is held for more than 2 years and up to 3 years – 1/3 of the full SSD rate.

No SSD will be payable by the vendor if the property is sold more than 3 years after it was bought. Please see Annex for examples of how the SSD will be computed.

6) The extended SSD will not affect HDB lessees as the required Minimum Occupation Period for HDB flats is at least 3 years.

7) IRAS will be releasing an updated e-tax guide on the circumstances under which SSD will apply and the procedures for paying SSD. The e-tax guide will be available at www.iras.gov.sg. Taxpayers with enquiries may call IRAS at 6351 3697 or 6351 3698.

Increase the Minimum Cash Payment from 5% to 10% of the Valuation Limit for Property Purchasers with one or more outstanding Housing Loans

8) Previously, property buyers have to make cash payment of at least 5% of the valuation limit5. With effect from 30 Aug 20106, the cash payment is increased from 5% to 10% of the valuation limit7. This measure is applied only to buyers of private residential properties, Executive Condominiums, HUDC flats and HDB flats (including those under the Design, Build and Sell Scheme, or DBSS flats) who are taking housing loans from financial institutions regulated by MAS and who already have one or more outstanding housing loans at the time of applying for a housing loan for the new property purchase.

Decrease the LTV limit for housing loans granted by financial institutions regulated by MAS from the current 80% to 70% for Property Purchasers with one or more outstanding Housing Loans

9) The LTV limit is lowered from 80% to 70% with effect from 30 Aug 20108 for borrowers who have one or more outstanding housing loans (whether from HDB or a financial institution regulated by MAS) at the time of applying for a housing loan for the new property purchase. Borrowers who do not have any outstanding housing loans continue to have an LTV cap of 80%. These rules apply to housing loans granted by financial institutions for private residential properties, Executive Condominiums, HUDC flats and HDB flats (including DBSS flats).

10) Loans granted by HDB for HDB flats (including DBSS flats) will still have an LTV cap of 90%. HDB loans are offered to eligible first-time flat buyers and second-timers who are right-sizing their flats to meet their housing needs. They are required to utilise all of their CPF Ordinary Account balance before HDB loans will be granted. Furthermore, those taking a second concessionary HDB loan must use the CPF refund and 50% of the cash proceeds from the sale of their previous flat before they are granted an HDB loan. This is in line with HDB’s home ownership policy of helping eligible buyers, especially first-time buyers, purchase public housing in a financially prudent manner.

11) Financial institutions’ lending standards have remained prudent and the asset quality of housing loans has stayed robust, with the non-performing loans ratio at less than 1% as at Q2 2010. Nonetheless, there are signs that more housing loans are originating at higher LTV bands of above 70%. In line with the objective of ensuring a stable and sustainable property market, lowering the LTV limit sends a clear signal to financial institutions to maintain credit standards, and encourages greater financial prudence among property purchasers already servicing one or more outstanding housing loans.

Adequate Supply in the Pipeline

12) The Government will also continue to ensure that there is adequate supply of housing to meet demand. In the second half 2010 GLS Programme, we have made available sites that can yield about 13,900 private housing units, of which about 8,100 units will be from sites on the Confirmed List. This is the highest potential supply quantum in the history of the GLS Programme. We will inject an even larger supply of private housing in the first half 2011 GLS Programme, if demand continues to be strong.

13) Apart from the supply from the GLS Programme, there are also 61,800 uncompleted units of private housing from projects in the pipeline as at 2Q20109. Of these, 32,600 units were available or could be made available for sale. These comprised units that had been launched for sale by developers, units that had pre-requisite conditions for sale10 and which could be launched for sale immediately, as well as units with planning approvals for which pre-requisite conditions for sale could be obtained quickly from the Government and made available for sale11.

14) The Government will continue to monitor the property market closely and will introduce additional measures if required later, to promote a stable and sustainable property market.